Murphy: Expand NJ property tax rebates to 1.3 million more homes

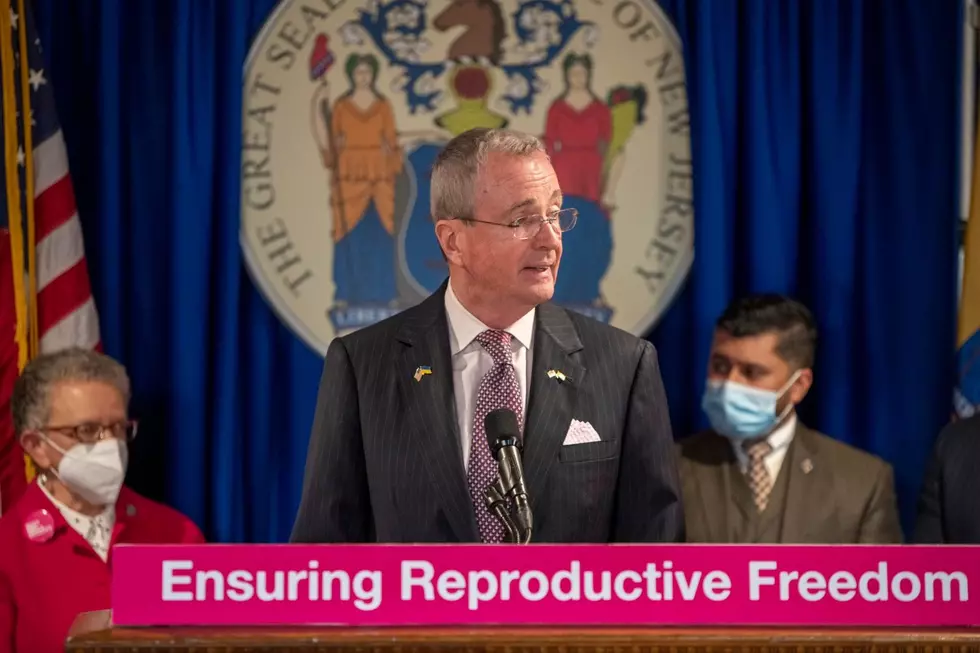

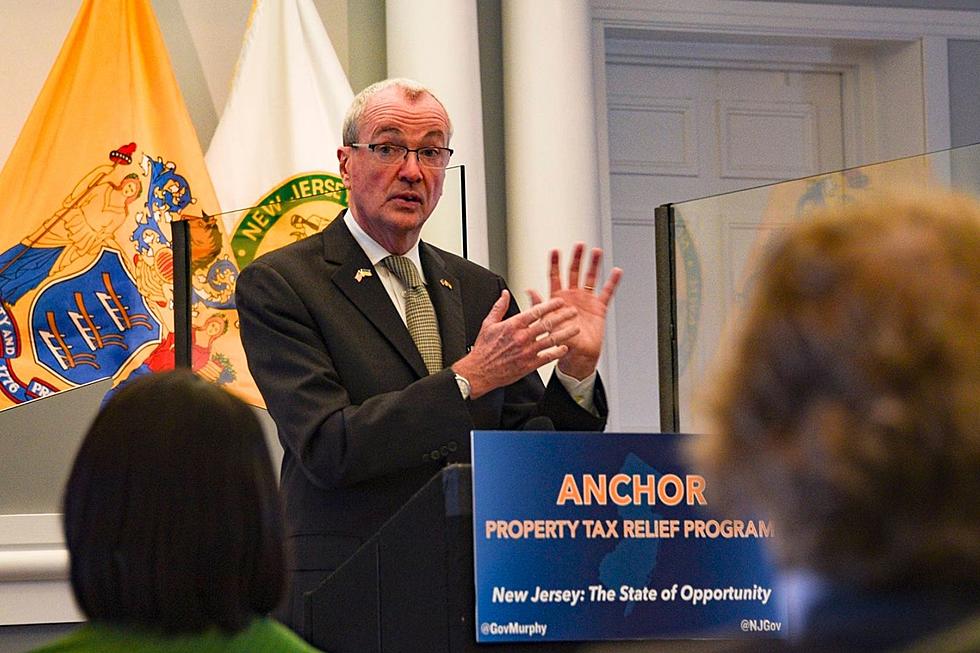

FAIR LAWN – Gov. Phil Murphy will include an expanded property tax rebate program in the state budget he proposes next week, with benefits averaging nearly $700 this year for homeowners with incomes of up to $250,000.

The program would be phased in over three years and eventually provide homeowners with rebates averaging $1,150, Murphy said. Renters who’ve been dropped from the current homestead rebate program would be newly eligible and receive up to $250 if their incomes are $100,000 or less.

Murphy said property tax increases have slowed, averaging 2% in recent years, and that the new program would lower the effective property tax cost back to 2016 levels for many households.

“While we continue this work, we will deliver direct relief to effectively undo years of property tax increases,” Murphy said.

Murphy said a $700 rebate represents more than 7% of the average tax bill of $9,284. By 2025, once fully phased in, it would be closer to a 12% rebate.

“Those words have never been spoken in the past three decades,” Murphy said – skipping over the tenure of Gov. Jon Corzine, who had boosted rebates to over $1,000 but then slashed them when the Great Recession struck.

Murphy is calling his proposal the ANCHOR Property Tax Relief Program, an acronym for Affordable New Jersey Communities for Homeowners and Renters. It would replace the homestead benefit program.

“We want this to mean lasting relief that keeps families in their homes. They want relief that will allow them to anchor themselves in the communities they love,” Murphy said.

Murphy said the program would cost $900 million in the upcoming state budget, increasing to $1.5 billion by fiscal 2025.

The homestead benefit program costs almost $340 million in the current budget. It is available to seniors and disabled homeowners with incomes up to $150,000 and other homeowners with incomes up to $75,000. Renters used to be in the program but aren’t currently.

Murphy said ANCHOR would reach around 1.15 million homeowners and more than 600,000 renters. In the most recent year, homestead tax credits averaged $620 – but only around 450,000 were paid out, according to the most recent state data, down from 697,000 five years ago.

State Treasurer Elizabeth Maher Muoio said the ANCHOR program more than triples the number of residents getting help through the Homestead Rebate program.

“Our goal is for New Jersey’s next normal to be fairer for every household,” Muoio said.

Lt. Gov. Sheila Oliver, whose Department of Community Affairs oversees local governments, said property taxes are “the number one concern” of residents, from whom she often hears inquiries about whether they’ll be getting a rebate check that year.

“It heightens the consciousness of anyone that works in Trenton that we have to deliver some relief to our homeowners,” Oliver said.

Republicans say it doesn’t go far enough, given the current struggles with inflation and the possibility that the program will be scaled back, not ramped up, in future budgets.

Senate Republicans introduced legislation that would commit $3 billion to tax relief through refundable tax credits when taxpayers file their state income taxes for 2021 this spring – $500 for individuals who are single and $1,000 for those filing jointly.

Taxpayers with incomes over $500,000 would be excluded. People who file their tax returns before the proposal is enacted, presuming it is, wouldn’t have to amend their returns, as the legislation directs the Treasury Department to send it to them automatically.

“We’re proposing direct tax relief that would put real cash back into people’s wallets quickly,” said Senate Minority Leader Steve Oroho, R-Sussex.

Assembly Minority Leader John DiMaio, R-Warren, said rebate programs don’t address the root causes of rising property taxes.

“This program is like putting gauze over a permanent wound instead of a Band-Aid,” DiMaio said. “It is covering more, but property taxes will continue to bleed household budgets. He doesn’t deserve a pat on the back for this stunt. It’s more of the same.”

Michael Symons is the Statehouse bureau chief for New Jersey 101.5. You can reach him at michael.symons@townsquaremedia.com

Click here to contact an editor about feedback or a correction for this story.

2021 NJ property taxes: See how your town compares

NJ towns that actually cut property taxes in 2020

More From 105.7 The Hawk