A bigger windfall for NJ taxpayers? See how much you’d get under proposed rebates

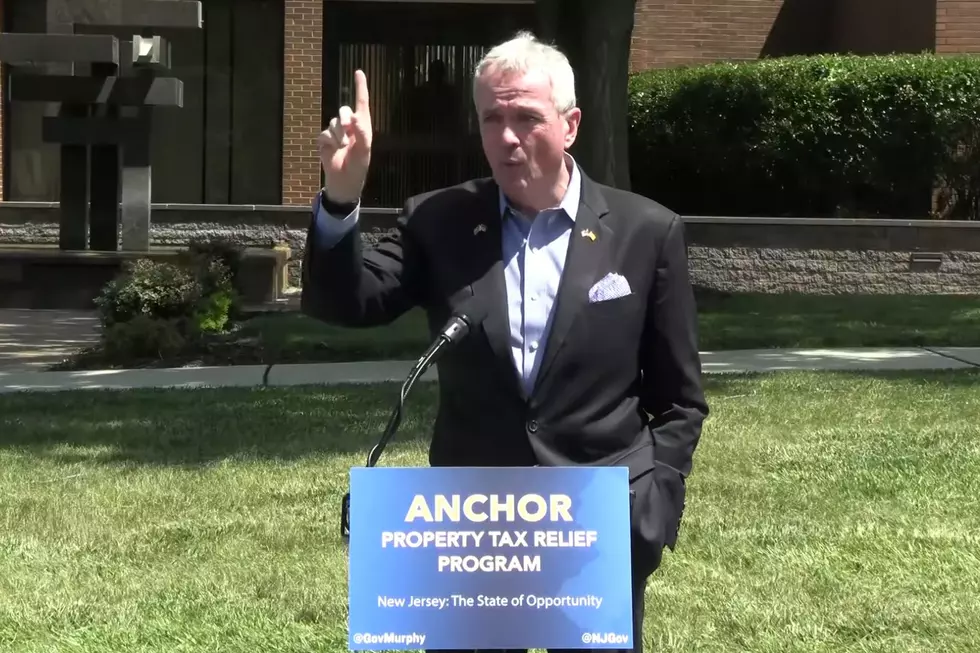

SOUTH BRUNSWICK – Gov. Phil Murphy and legislative leaders say they’ll use some of the state’s unprecedented revenue surge to speed up and increase the property tax relief promised to most homeowners and renters in the governor’s original budget plan.

The direct property tax relief would be as follows:

— $1,500 for homeowners with incomes up to $150,000

— $1,000 for homeowners with incomes between $150,000 and $250,000

— $450 to renters with incomes up to $150,000

“This is $1,500 in direct property tax relief for the majority of middle-class and working homeowners this year,” Murphy said. “That’s real relief. It is a promise kept. And it is a meaningful reduction in property taxes.”

ANCHOR benefits will be paid to homeowners as a property tax credit directly applied to their property taxes each year and to renters as a check or direct deposit from the state Treasury Department.

Murphy said the ANCHOR program benefits will be paid this year – "This year, it'll be right in the here and now," he said – but Treasury Department spokeswoman Danielle Currie later said all payments are expected to be issued in May 2023, which is toward the end of the upcoming state fiscal year.

The average property tax bill in New Jersey was $9,284 last year. Murphy said a $1,500 rebate amounts to around 16% of that bill and pushes the effective tax bill to less than $7,800, a level that the state’s average tax bill hasn't seen since 2011.

'An obligation to give that money back'

Assembly Speaker Craig Coughlin, D-Middlesex, said it’s the rare instance when going backwards isn’t a bad thing.

“This is something that we’ve worked hard to make sure that it will be sustainable in the years to come because that’s what truly is important – that we do something that has a profound impact not just today, but in the years to come,” Coughlin said.

The state’s 2022 budget, which wraps up in a few weeks, originally anticipated $42.3 billion in revenue when adopted last June. The Murphy administration raised its forecast to $46.9 billion in March, then to $51.4 billion last month.

“This unprecedented economic growth that we’ve seen here in New Jersey has increased state revenues to historic levels,” said Senate President Nick Scutari, D-Union. “And we have an obligation to give that money back.”

Program cost to top $2 billion

The ANCHOR program – short for Affordable New Jersey Communities for Homeowners and Renters – rebrands and expands the homestead rebate program. The state now expects to spend more than $2 billion on the program in its first year, up from the original budget of $894 million.

In its original form, it was going to ramp up gradually over three years and eventually cost $1.5 billion. In the first year, homeowners were originally going to receive an average $700 rebate, growing to $1,150 by fiscal 2025. Renters were going to receive $250.

Tenants last received property tax relief from the state in fiscal 2010.

More than 2 million New Jersey households are expected to receive rebates. Murphy says they are home to roughly 5.5 million of the state’s 9.3 million residents, nearly 60% of the population.

Program beneficiaries are expected to include more than 870,000 homeowners with incomes up to $150,000; more than 290,000 homeowners with incomes between $150,000 and $250,000; and more than 900,000 renters with incomes of up to $150,000.

First on the chopping block

Assembly Minority Leader John DiMaio, R-Warren, called the plan "bribing people with their own money.”

“Injecting steroids into Murphy’s recycled rebate program won’t get anyone more excited about it than when Murphy announced it in February,” DiMaio said. “It doesn’t deliver meaningful changes in fiscal policy and will be the first program to get cut when money is tight.”

Senate Republicans said they will attempt to force a vote at the Senate session Thursday on their legislation that would pay $1,000 rebates to 4 million families, a plan they introduced three months ago.

“During that time, our proposal has languished in the Democrat-run Legislature while gas prices continue hitting new records, soaring inflation is driving up the cost of groceries, and tax overcollections by our Treasury Department have ballooned to nearly $9 billion,” said Senate Minority Leader Steve Oroho, R-Sussex.

The New Jersey Business and Industry Association said the program provides no relief to business owners, who pay nearly half of the state’s property taxes.

“With this continued omission of relief for businesses which continue to struggle post-pandemic with skyrocketing inflation, fuel costs and labor challenges, it is even more imperative that our policymakers bring more immediate affordability to our job creators as this budget cycle comes to a close,” said Michele Siekerka, the NJBIA’s president and chief executive officer.

Michael Symons is the Statehouse bureau chief for New Jersey 101.5. You can reach him at michael.symons@townsquaremedia.com

Click here to contact an editor about feedback or a correction for this story.

2021 NJ property taxes: See how your town compares

COMPARE: Highest 2020 property taxes in each county

More From 105.7 The Hawk