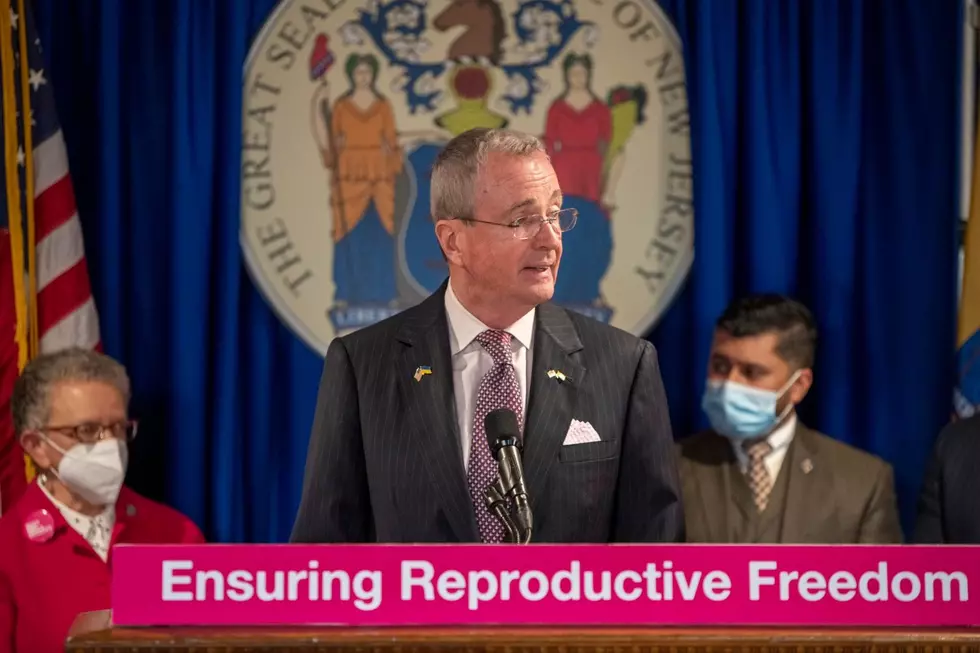

Senate GOP presses Murphy to ‘Give It Back’ on taxes, pandemic

TRENTON – Senate Republicans announced an online petition and social media campaign called the “Give It Back” initiative, designed to pressure Gov. Phil Murphy to cut taxes and end the pandemic-era rules he has instituted over the past two years.

“Gov. Murphy has taken so much from New Jerseyans since the start of the pandemic,” said Senate Minority Leader Steve Oroho, R-Sussex. “He’s taken money, he’s taken power, and he’s taken rights, choices and freedoms from every single New Jerseyan.”

“On issue after issue, there is no question that it’s time for the governor to give back everything he’s taken from the people of New Jersey, especially clearly where what he’s taken is too much and unfair and unproductive,” said Sen. Declan O’Scanlon, R-Monmouth.

Sen. Mike Testa, R-Cumberland, cited vaccine mandates for healthcare and correctional workers, business lockdowns in 2020 that led some to close permanently and a rise in violent crimes he pinned on the early release of state inmates to limit the spread of the virus in close living quarters.

“We are asking New Jerseyans to post short messages and videos on Twitter, Facebook, Instagram and other social media platforms telling Gov. Murphy what he’s taking from them and to give it back,” Testa said.

He said that if people tag the posts with #GiveItBack, “Gov. Murphy can see how much he has taken from New Jerseyans and help him make the right decision to give it back.”

The petition had 359 signatures as of 7:30 p.m. Thursday.

Murphy must decide by next Thursday whether to extend the renewed public health emergency by another month.

Republicans opposed the reinstatement of the emergency last month, with O’Scanlon introducing another bill to limit it. And they said its extension is certainly unwarranted given the latest COVID trends – including an 86% drop in cases since the Jan. 10 omicron peak, from a seven-day average of 31,839 cases a day to 4,443. It’s the lowest since Dec. 13.

But Oroho said the idea started with state revenue trends, not the emergency renewal. Republicans estimate the state will collect $3 billion beyond its budget expectations this fiscal year.

“The idea that they’re taxing too much – give it back,” Oroho said.

“Really, truly an obscene amount of money that the state is holding or will hold shortly that’s not in people’s wallets. It’s not in business people’s budgets,” said O’Scanlon, the Republican budget officer. “We need to give that back.”

As of December, halfway through the state budget year, revenues were up $3.4 billion or 23.5% from the same six-month period a year earlier. But the Treasury Department said $792 million came through a relatively new alternative business tax that will be largely offset with tax credits in tax-filing season.

Republicans remain the minority party in the Legislature, despite having gained one Senate seat and six Assembly seats in last year’s election, so any action on their bills would require Democratic support.

“If you’re a legislator who says you don’t back our whole ‘give back’ effort and my bill, what you’re saying is, ‘I’m spineless, and I don’t want to do my job.’ That’s a hell of a message to be sending to your constituents who loud and clear sent a message last November,” O’Scanlon said. “They don’t want to hear that. They don’t want to hear that cop-out.”

Michael Symons is State House bureau chief for New Jersey 101.5. Contact him at michael.symons@townsquaremedia.com.

2021 NJ property taxes: See how your town compares

NJ Diners that are open 24/7

More From 105.7 The Hawk