A tax cut in NJ?! You might start noticing it in your paycheck

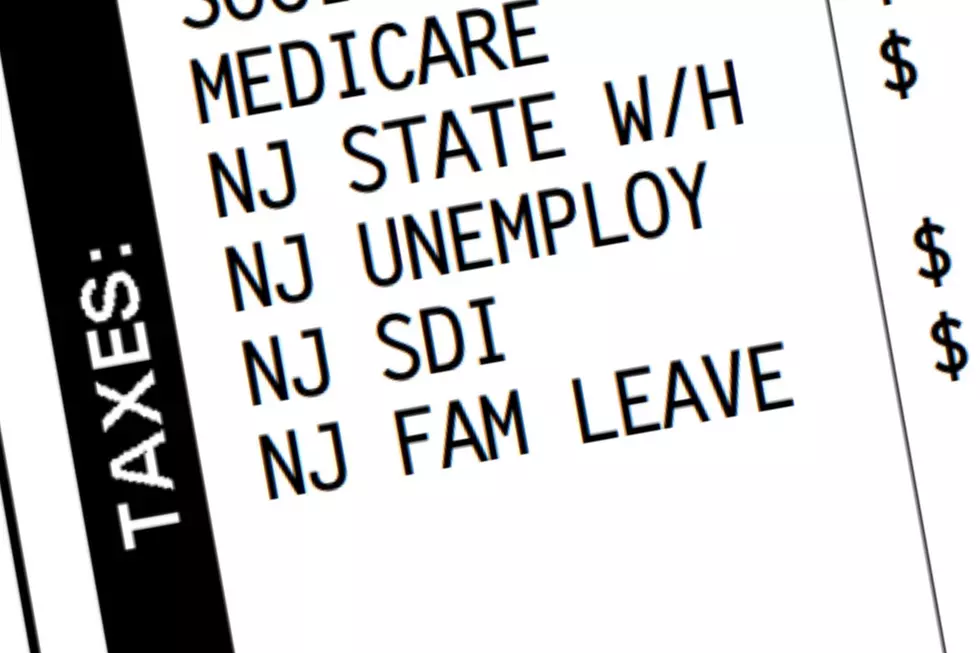

TRENTON – A bit of good news for New Jerseyans: Taxes withheld from paychecks for temporary disability and family-leave insurance are going down starting in January.

The reductions will save workers an average of $111.50 over the course of 2023, according to the state Department of Labor and Workforce Development. In all, that adds up to nearly $450 million.

Taxes were raised starting in 2020 for temporary disability insurance and family leave insurance, in order to pay for more generous benefits. But they have now declined for two years in a row, as the fund balances have outpaced benefit payments.

Are workers missing out?

The Labor Department said the enhanced unemployment benefits provided in 2020 and 2021 at the height of the pandemic contributed to a decrease in TDI and family leave claims.

“While I’m glad our temporary disability and family leave funds are robust, thus resulting in a decrease to contribution rates, it also indicates that workers may be missing the opportunity to utilize these vital programs,” said Labor Commissioner Robert Asaro-Angelo.

“We’re working with our partners in the community to increase awareness of these critical resources so workers know their rights and take the time they need and deserve to care for themselves and their families without risking their job or paycheck,” he said.

The state is spending $1.1 million on grants to promote outreach, education and access to the paid-leave programs.

Your savings may vary

Workers’ contribution rates for temporary disability will drop from 0.14% to zero, saving an average worker $56.25. That rate was 0.47% as recently as 2021, which meant workers making $138,200 or more were paying nearly $650 in TDI taxes.

The rate for paid family leave will drop to 0.06% from 0.14%, saving $55.25. The FLI tax rate was 0.28% in 2021, maxing out at $387 for the highest-paid workers. For 2023, the maximum family-leave tax will be $94 on someone making $156,800 or more.

Savings vary by a person’s salary. Someone making $50,000 would take home $110 more. Someone making $100,000 would pay $220 less. Someone making $150,000 would save close to $300.

To calculate the tax rates each year, the state projects how much it expects to spend on benefits over the next year, adds 20% for temporary disability and 25% for family leave to ensure there’s a cushion in the fund, then subtracts the prior-year account balance.

Won't last forever

For that reason, the tax cut could be a welcome but temporary reprieve. The balance in the TDI fund is projected to dwindle from over $900 million now to under $500 million by the end of 2023. The family leave account is expected to dip from over $300 million now to around $112 million.

Overall, the roughly 4 million workers in New Jersey will take home an additional $223 million per program next year.

Employers will also contribute less toward the temporary disability insurance program, reducing their tab by a collective $20 million. Employers don’t pay into the family leave program.

However, that decline doesn’t nearly match the estimated $300 million increase in what employers are paying into the unemployment fund for the fiscal year that started in July. That fund still has a low balance because of how many people got benefits after losing their jobs in 2020.

The expanded TDI and FLI programs make workers eligible for up to 85% of the average weekly salary, up from the previous 67%. The maximum weekly benefit is $993.

The amount of family leave benefit time was doubled to 12 consecutive weeks per year, and intermittent time off was increased to 56 days from the previous 42 days.

Michael Symons is the Statehouse bureau chief for New Jersey 101.5. You can reach him at michael.symons@townsquaremedia.com

Click here to contact an editor about feedback or a correction for this story.